company income tax rate 2019 malaysia

On the First 5000. Public Provident Fund PPF is a government-initiated tax-saving investment option used by the citizens of India.

Taxing Corporations Might Be Good Politics But It S Still Bad Policy Cato Institute

The Walt Disney Company commonly known as Disney ˈ d ɪ z n i is an American multinational mass media and entertainment conglomerate headquartered at the Walt Disney Studios complex in Burbank CaliforniaDisney was originally founded on October 16 1923 by brothers Walt and Roy O.

. It was based in the garage of Susan Wojcicki in Menlo Park California. Bulk Material Handling Market Slowly But Steadily Gaining Momentum To Reach 5683 Bn Mark In 2026. It is considered in Islam as a religious obligation and by Quranic ranking is next after prayer in importance.

The highest rate of income tax peaked in the Second World War at 9925. Tax Rate of Company. By the 2019 Tax Reform.

In Malaysia for a period of less than 182 days during the year but that period is linked to a period of physical presence of 182 or more consecutive days in the following or preceding. However subject to conditions the following foreign-sourced income received in Malaysia from 1 January 2022 to 31 December 2026 qualify for tax exemption. Sections 107A 1a and 107A 1b 10 3.

Is a Brazilian multinational corporation engaged in metals and mining and one of the largest logistics operators in Brazil. Corporation tax rate 1 April 2016. Based on GUIDELINES ON TAXATION OF ELECTRONIC COMMERCE TRANSACTIONS released by the LHDN on 13th May 2019 it considers payments made to Facebook Google and the like to be similar to payment for the use and right.

TV-avgift literally TV fee in Sweden was scrapped and replaced by a general public service fee Swedish. Google was initially funded by an August 1998 investment of 100000 from Andy. Material Handling Equipment Market 2019.

For income tax purposes the remaining schedules were superseded by the Income Tax Trading and Other Income Act 2005 which also repealed Schedule F. ˈ f aɪ z ər FY-zər is an American multinational pharmaceutical and biotechnology corporation headquartered on 42nd Street in Manhattan New York CityThe company was established in 1849 in New York by two German entrepreneurs Charles Pfizer 18241906 and his cousin Charles F. Vale is the largest producer of iron ore and nickel in the world.

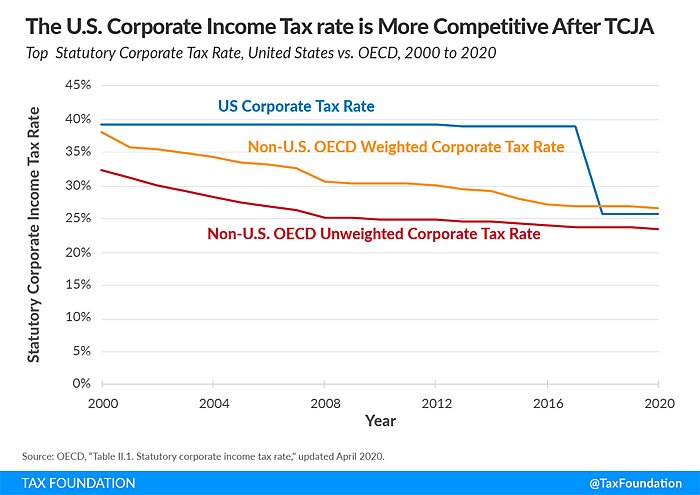

In 1980 corporate tax rates around the world averaged 4011 percent and 4652 percent when weighted by GDP. On the First 2500. Inland Revenue Board of Malaysia shall not be liable for any loss or damage caused by the usage of any.

With effect from Wef 1 January 2022 income derived from outside Malaysia and received in Malaysia by tax residents will be subject to tax. Collagen And Gelatin Market Industry Analysis 2023. It also produces manganese ferroalloys copper bauxite.

An individual is regarded as tax resident if he meets any of the following conditions ie. Company size and income. Average Lending Rate Bank Negara Malaysia Schedule Section 140B Restriction On Deductibility of Interest Section 140C Income Tax Act 1967 International Affairs.

Paid-in capital of over 100 million Japanese yen JPY. For corporation tax purposes the Schedular system was repealed and superseded by the Corporation Tax Acts of 2009 and 2010. For example you have until April 15 2024 to claim a 2020 Tax Refund April 15 2023 to claim 2019 Tax Refund and for 2018 until April 18 2022.

The companyLLP must be incorporated or registered in Malaysia and is a tax resident for tax purposes. - turnover value exceeding RM100 million. Public Provident Fund can also be called a.

Vale SA formerly Companhia Vale do Rio Doce the Sweet River Valley Company referring to the Doce River Portuguese pronunciation. The companyLLP must have a paid-up capital of ordinary sharescapital contribution not exceeding RM25 million at the beginning of the basis period for the year of assessment the tax rebate claim is made. PPF was introduced in 1986 by the National Savings Institute of the Ministry of Finance to initiate savings in form of investment along with the benefit of return on it.

PPF Interest Rate 2022- All You Need to Know. The flat tax rate is applicable for a five-year period starting with the first day of work in Korea to the end of the tax year immediately preceding the year in. It also operated under the.

That which purifies also Zakat al-mal zaˈkaːt alˈmaːl زكاة المال zakat on wealth or Zakah is a form of almsgiving often collected by the Muslim Ummah. Allmän public service-avgift which is a flat income-based public broadcasting tax of 1 per person capped at 1300 Swedish kronor approximately US145 or 126 per year. In Malaysia for at least 182 days in a calendar year.

One saving grace is that Thailand does not have a 45 tax rate like some countries and in 2019 the 30 tax rate band was expanded so you can earn more at that rate before being put onto the 35 band. A foreign expatriate or employee can choose the 19 flat tax rate as a monthly employment income withholding tax WHT rate with submission of an application to Korean tax authorities. Craig Silverstein a fellow PhD student at Stanford was hired as the first employee.

Individuals whose income is less than Rs25 lakh per annum are exempted from tax. As one of the Five Pillars of Islam zakat is a religious duty for all Muslims. Calculations RM Rate TaxRM 0-2500.

Since then countries have recognized the impact that high corporate tax rates have on business investment decisions so that in 2021 the average is now 2354 percent and 2544 when weighted by GDP for 180 separate tax. Income Tax Slab for Financial Year 2019-20. Average annual growth rate of current and RD expenditure per full-time equivalent student by type of institution 2012-2019 Enrolment data adjusted to the financial year Reference Statistics for Finance Indicators.

Where the taxable profits can be attributed to the exploitation of patents a lower effective rate of tax applies. The resident taxpayers are divided into three categories based on an individuals age. Canadian Cannabis Company claims their cannabis cigarettesare the right way to medicate.

On 1 January 2019 the television licence Swedish. The income tax slab is a slab under which an individual fall is determined based on the income earned by an individual. The normal rate of corporation tax is 19 for the financial year beginning 1 April 2021 and will be maintained at this rate for the financial year beginning 1 April 2022.

And - the value of the proposed covered transaction is for sales if it exceeds 50 of turnover. All forms of earnings are generally taxable and fall under the personal income tax bracket. Income Tax Act 1967 Withholding Tax Rate Payment Form.

Disney as the Disney Brothers Studio. Be aware that you can only claim your tax refund for a previous tax year within three years of the original tax returns due date or deadline. - a taxpayer who is a company assessable and chargeable to tax under the Income Tax Act 1967 also includes permanent establishment PEs.

For all other back taxes or previous tax years its too. Global Nebulizer Accessories Market Research Report 2019-2024. General corporation tax rates.

The rate is 10. Pfizer develops and produces medicines and. Similar to the local corporate special tax the special corporate business tax will be levied on the tax amount of the local business tax income portion and collected by the local.

Tax Changes In Malaysia S 2022 Budget

Singapore Raises Income Tax Rates For Top 5 Per Cent And Malaysia Anilnetto Com

Solved Please Note That This Is Based On Philippine Tax System Please Put Course Hero

Federal Income Tax Rates For 2019 2020 H R Block

Real Property Gains Tax Rpgt In Malaysia 2022

Malaysia Corporate Income Tax Rate Tax In Malaysia

Malaysia Market Profile Hktdc Research

Corporate Tax Rates Around The World Tax Foundation

Is Corporation Tax Good Or Bad For Growth World Economic Forum

Corporate Tax Rates Around The World Tax Foundation

2020 E Commerce Payments Trends Report Malaysia Country Insights

Withholding Tax On Foreign Service Providers In Malaysia

Malaysia Average Monthly Household Income By Ethnic Group 2019 Statista

Why It Matters In Paying Taxes Doing Business World Bank Group

Guam Corporate Tax Rate 2022 Data 2023 Forecast 2015 2021 Historical Chart

Investment Holding Company Determination Of Gross Income Of A Company Or Limited Liability Partnership Cheng Co Group

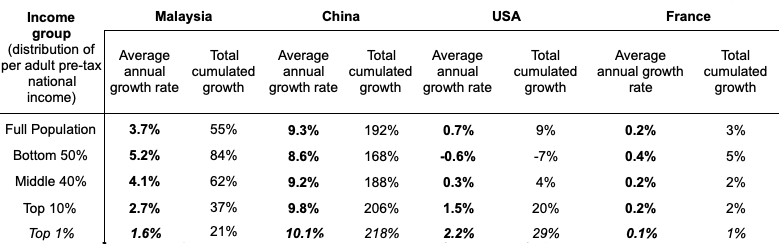

Income Inequality Among Different Ethnic Groups The Case Of Malaysia Lse Business Review

Comments

Post a Comment